The European Parliament and the Council of the European Union today reached an agreement to require large companies operating in Europe to conduct human rights and environmental due diligence over harms in their value chains. The proposed EU Corporate Sustainability Due Diligence Directive (directive) represents a long-awaited commitment by EU governments to no longer tolerate irresponsible business conduct and help protect rightsholders globally. But serious gaps in the directive’s alignment with international standards including the OECD Guidelines underscore the need for more government action to ensure policy coherence and accountability for corporate harms.

New duties for companies to address human rights and environmental abuse

The agreed directive text would require the largest companies in Europe to undertake human rights and environmental due diligence to identify, assess, cease or mitigate, and remedy harm they have caused, contributed to, or are directly linked to in their value chains. This means many EU and foreign companies, their subsidiaries, and their business relations can no longer claim ignorance of their harms to people and the planet, and must be accountable to rightsholders and the public.

New measures to strengthen accountability and remedy for victims

The text also introduces monetary sanctions based on turnover for companies that fail to comply with the new duties, as well as a network of authorities in EU Member States that must be equipped to receive complaints from rightsholders. OECD Watch is encouraged that today’s deal maintains strong access to justice measures for victims of corporate abuse, particularly around increasing access to evidence and ensuring reasonable time limits to file claims.

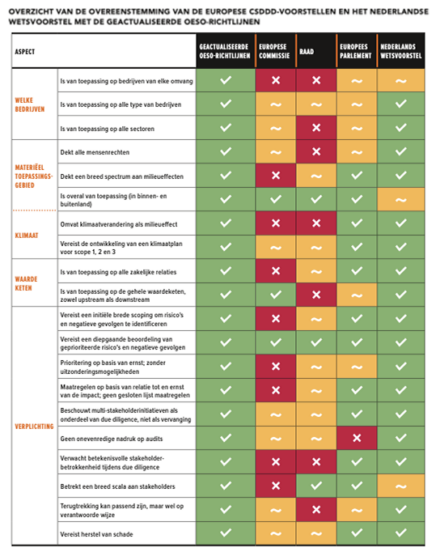

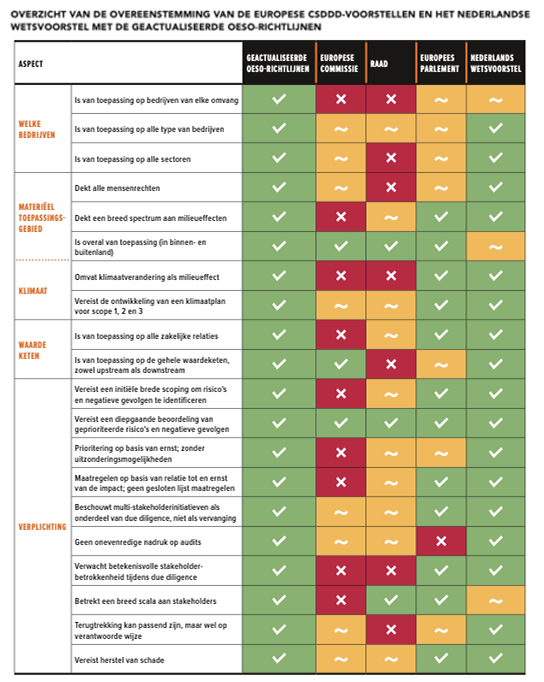

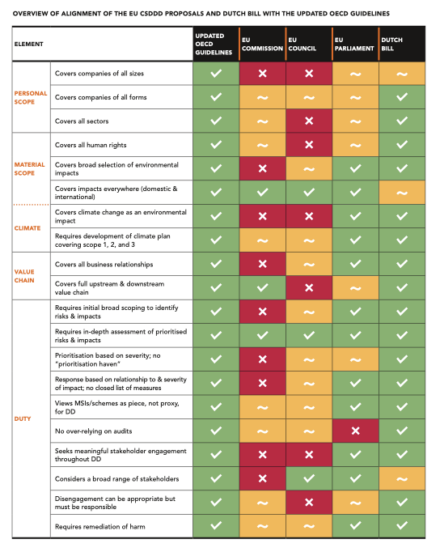

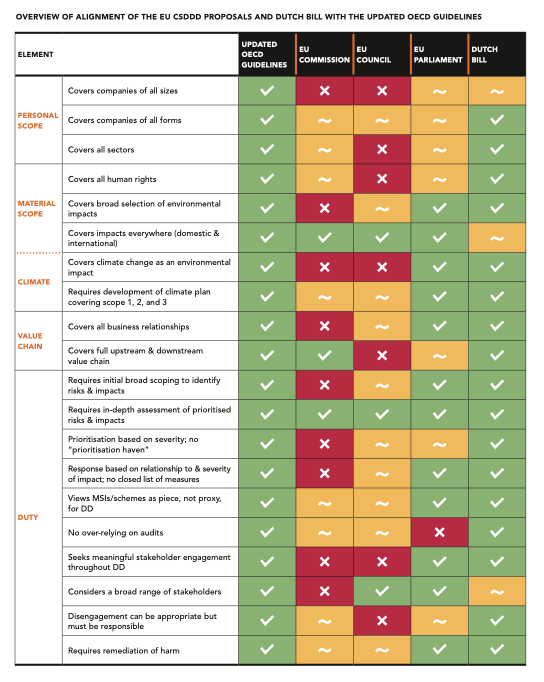

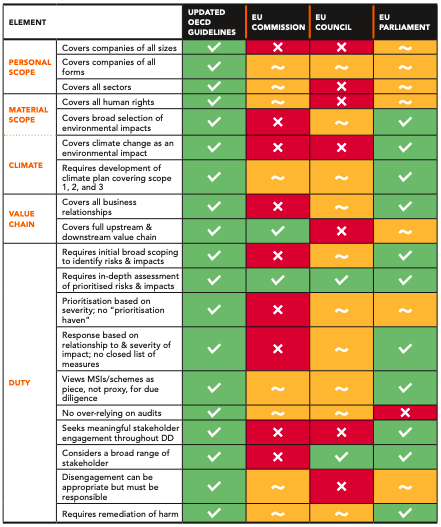

Gaps in alignment with the broad scope of the OECD Guidelines

Notwithstanding many strong elements, the directive falls seriously short of alignment with the broad personal, subject matter, and value chain scope of the OECD Guidelines for Multinational Enterprises on Responsible Business Conduct (OECD Guidelines). For example:

• Limited coverage of financial sector: While the OECD Guidelines apply equally to multinational enterprises across all sectors, the directive’s new duties will apply only in an extremely weakened form to banks and insurance companies, and not at all to asset managers. OECD Watch, which has marked a rising trend in Guidelines complaints targeting financial institutions, is deeply disappointed with this shortcoming.

• Weak duties on climate impacts: While the OECD Guidelines reference the Paris Agreement and require companies to adopt and implement science-based greenhouse gas emissions targets aligned with international climate goals, the directive does not reference the Paris agreement and would attach no liability to companies’ failure to implement their climate plans. OECD Watch regrets that the directive does not require more meaningful action on climate change by companies.

• Limited downstream scope: While the OECD Guidelines require companies to address equally impacts that occur both “up-“ and “downstream” of them in their value chains, the directive sets a narrower scope of coverage of downstream impacts. OECD Watch has documented numerous cases across numerous sectors involving downstream impacts and is concerned the directive will not support justice in similar situations.

Directive is out-of-synch with governments’ own call for alignment with the Guidelines

OECD Watch is not the only one that has advocated strong alignment between the OECD Guidelines and national and regional law and policy on responsible business conduct: In December 2022, OECD member states adopted a Recommendation committing to develop legal frameworks to enable RBC that align with the OECD Guidelines. And as recently as February 2023, 50 states, including 25 of the 27 EU Member States, signed a Declaration calling for alignment between national and regional responsible business conduct initiatives and the OECD Guidelines. A similar call has also been made repeatedly by many enterprises, who seek policy coherence as the key to avoiding a proliferation of diverse and, at worst, conflicting expectations.

CSDDD is first step; next steps needed

Leading companies have already long been applying the standards laid out in the international norms, and rightsholders have come to rely on them. Policy makers in the EU and other countries that adhere to the OECD Guidelines now must do more to bolster the international normative framework they have built. OECD Watch calls on governments to strengthen implementation of the Guidelines’ recommendations, not only by National Contact Points, but also through continued pursuit of stronger law and policy on responsible business conduct. OECD Watch is pleased that the European Commission has committed to developing a separate due diligence directive for the financial sector. OECD Watch urges prompt next steps in this regard and in the other areas of non-alignment in the directive’s text.

While policymakers announced a deal this morning, much remains unclear. OECD Watch will continue to engage with civil society and policy makers to encourage alignment with the Guidelines as a baseline, and will provide more detailed analysis once final text is released. OECD Watch will also continue to support civil society around the world in pursuing corporate accountability policy that meets or exceeds the standards of the Guidelines.