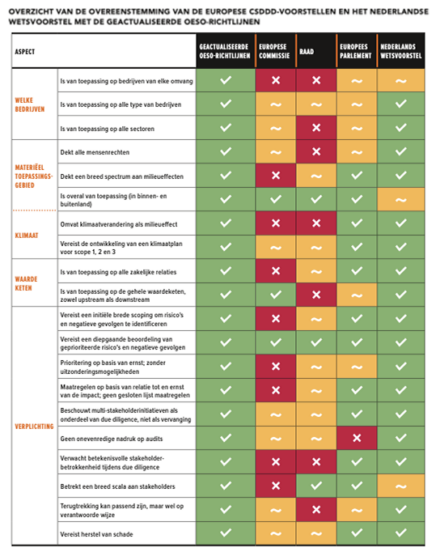

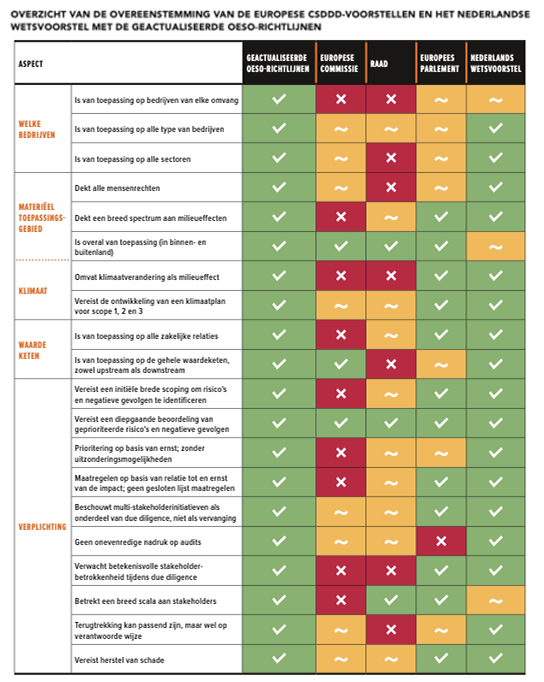

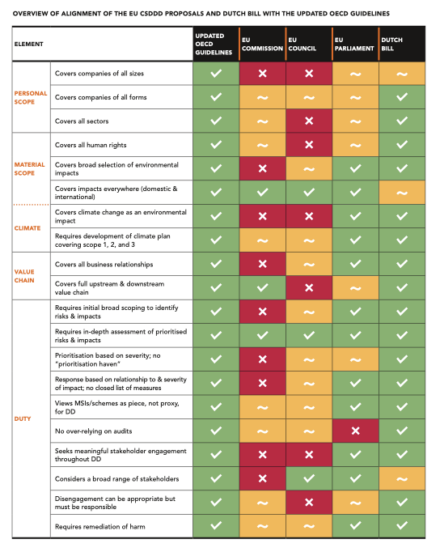

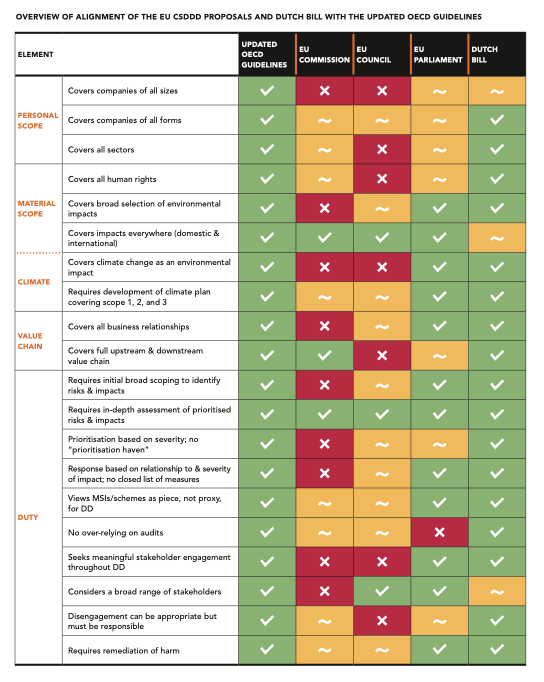

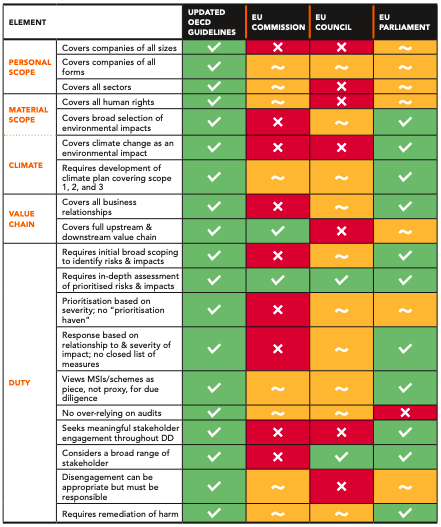

More than 60 non-governmental and civil society organisations, including OECD Watch, submitted a letter calling on EU Member States to enhance the Corporate Sustainability Due Diligence Directive (CSDDD) for meaningful global impact. The signatories outlined five key issues to ensure the CSDDD aligns with international standards and ensures tangible improvements for people and the planet. All five priorities must be achieved in the final directive.

One significant concern highlighted in the letter is the current EU Council Presidency proposal to exclude the financial sector from the CSDDD. The letter emphasises the importance of including meaningful due diligence obligations for key financial activities, such as lending, investing, and insurance. The rationale behind this plea is the vital role financial institutions play in shaping sustainable economic systems and influencing various economic sectors. The letter underscores their crucial role in upholding human rights, environmental protection, and global climate efforts.

The CSDDD presents an unprecedented opportunity to address regulatory gaps outlined in the EU’s Action Plan on Financing Sustainable Growth. Many investors have expressed support for ambitious legislation, making this a key moment to fortify sustainability frameworks.

Other key priorities include ensuring development of climate change transition plans as part of the due diligence obligation, removing restrictions around civil liability and promoting access to justice, ensuring full value chain coverage, and ensuring complete scope of covered rights and issues.

For a description of the issues and recommendations outlined by the organisations, we invite you to read the full letter.

read more less